We use cookies and similar technologies to recognise your repeat visits and preferences, as well as to measure the effectiveness of campaigns.

By clicking Allow, you agree to the use of cookies in accordance with our Privacy Policy.

Learn more.

BMBI Report - Q1 2024 report

Builders’ Merchant Q1 value sales fell -7.2% year-on-year, as volumes slide -8.7%

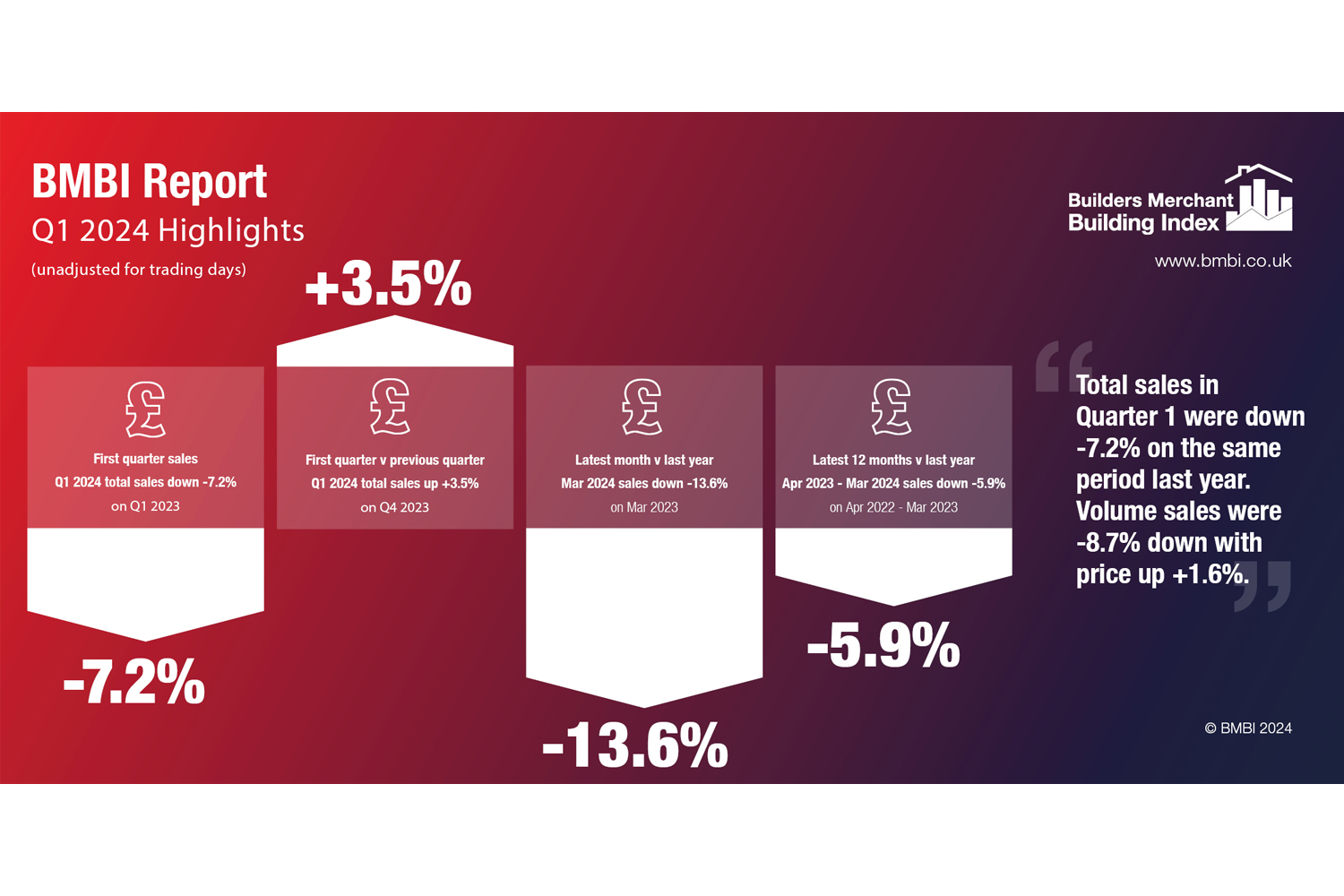

The latest Builders Merchant Building Index (BMBI) report reveals builders’ merchants’ value sales in Q1 2024 were -7.2% down compared to Q1 2023, with volume sales falling -8.7% and prices edging up +1.6%. With one less trading day in Q1 2024, like-for-like sales (which take the number of trading days into account) were -5.7% lower.

Just three of the twelve categories sold more in Q1, year-on-year, with Workwear & Safetywear (+11.5%) out in front. The two largest categories - Timber & Joinery Products (-10.6%) and Heavy Building Materials (-9.4%) - both sold less. Renewables & Water Saving (-26.5%) was the weakest category.

Quarter-on-quarter, total value sales for Q1 2024 were up +3.5% compared to Q4 2023. Volume sales were +3.9% higher and prices were flat (-0.4%). With three additional trading days in the most recent period, like-for-like sales were -1.4% lower. All but one category sold more with Landscaping (+14.6%) growing the most, followed by Tools (+6.0%). Renewables & Water Saving (-6.6%) was the only category to sell less.

Quarter 1 total value sales were negatively impacted by slow sales in March. Total Builders Merchants value sales for the month fell -13.6% compared to March 2023. Volume sales dropped -14.0% while prices edged up +0.5%. With three less trading days in March this year, like-for-like sales were -0.6% lower.

All categories sold less in March, but Workwear & Safetywear (-0.4%), Decorating (-5.0%), Landscaping (-6.8%), Tools (-9.2%), Kitchens & Bathrooms (-9.8%) and Plumbing Heating & Electrical (-11.9%) fell less than Total Merchants. The two largest categories - Heavy Building Materials (-15.2%) and Timber & Joinery Products (-17.7%) - were significantly down on the same month last year.

Month-on-month, Total Merchants sales were +3.7% higher in March 2024 than in February 2024. Volume sales were up +4.7% and price was down -1.0%. Half of the twelve categories sold more with two of the largest categories, Landscaping (+20.1%) and Heavy Building Materials (+3.9%), outperforming Total Merchants. Plumbing Heating & Electrical (-4.1%) and Renewables & Water Saving (-4.7%) lagged other categories.

Mike Rigby, CEO of MRA Research who produce this report, said: “Exceptionally wet weather in Q1 and a hold on interest rates did little to revive the faltering newbuild market. The National House Building Council (NHBC) recently confirmed that new home registrations in Q1 were down 20% on last year, and this drop in demand has been felt throughout the supply chain.

“Despite the clouds hanging over the sector – figuratively and literally – there may be a break ahead. The latest ONS data for Q1 shows a marked increase in new construction orders (+15.9% quarter-on-quarter), buoyed by private commercial orders for offices, health and entertainment premises, while GfK’s Consumer Confidence Index shows another 2-point increase in consumer confidence in April, following a positive March. The consumer confidence Overall Index Score is still negative (-19), but it’s a vast improvement on the picture a year before, with five of the underlying measures significantly better than April last year. Could lowering inflation and the promise of tax and interest rate relief and the prospect of a new Government be boosting consumer confidence? If so, it could be a welcome shot in the arm for the housing market – and merchants and their suppliers - as we head into summer.”

Set up and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation - is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for 88% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.

The Q1 2024 BMBI report is available to download at www.bmbi.co.uk.