We use cookies and similar technologies to recognise your repeat visits and preferences, as well as to measure the effectiveness of campaigns.

By clicking Allow, you agree to the use of cookies in accordance with our Privacy Policy.

Learn more.

BMBI Report - October 2022

October Merchant sales climb +7.5%, but inflation’s still driving growth

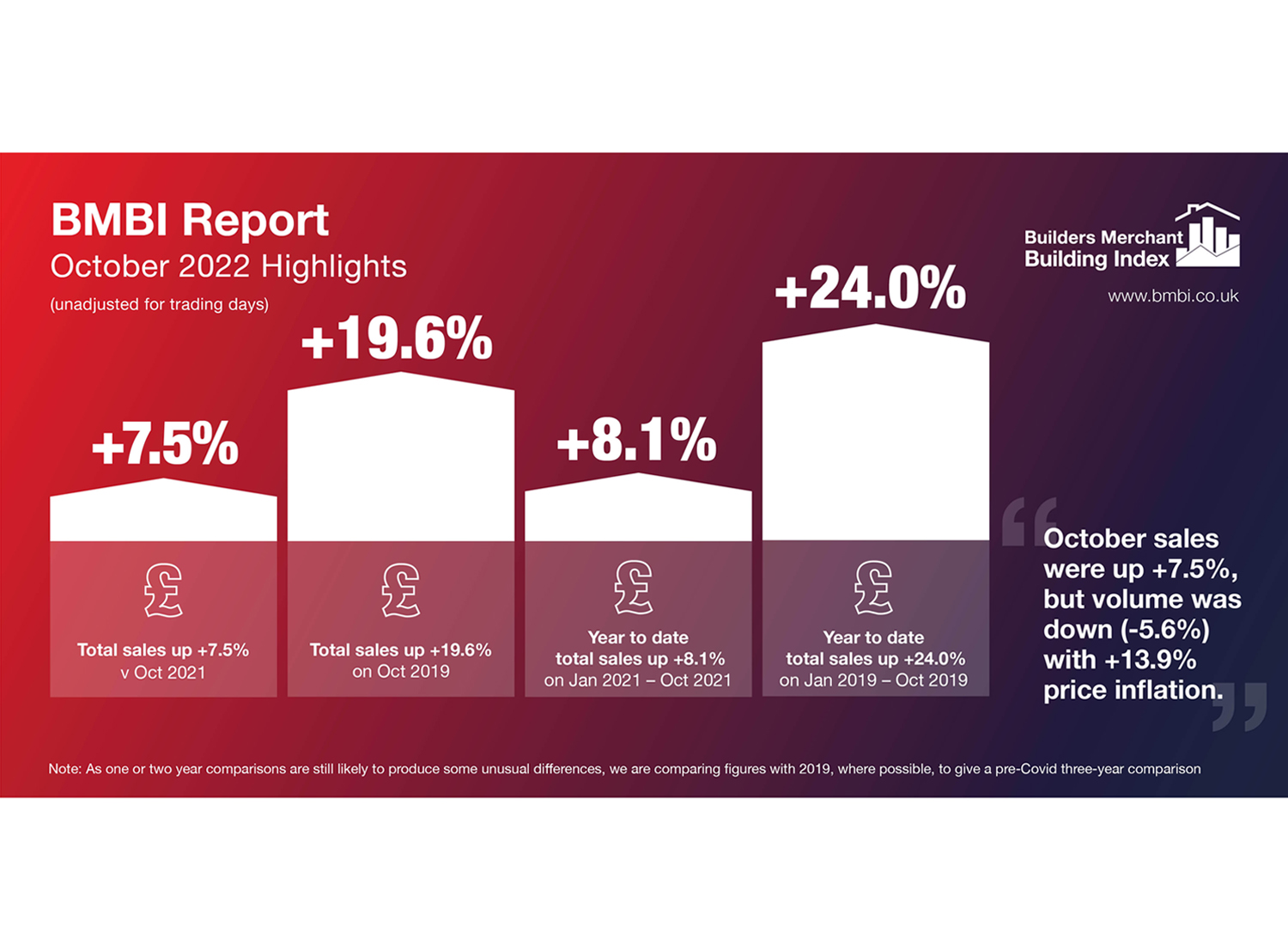

The latest Builders Merchant Building Index (BMBI) report reveals that builders’ merchants’ value sales were up +7.5% in October 2022 compared to the same month in 2021. Volume sales dropped again (-5.6%) while prices climbed +13.9%, so price inflation was the driving factor of growth.

Eleven of the twelve categories sold more in October compared to the previous year, with eight performing better than the Merchants overall. Renewables & Water Saving (+66.1%) was the standout category, while Plumbing, Heating & Electrical (+19.5%), Workwear & Safetywear (+19.0%) and Kitchens & Bathrooms (+17.5%) also had a good month. Timber & Joinery Products (-8.4%) was the only category to sell less.

Compared to pre-pandemic October 2019, total merchant value sales were +19.6% higher in 2022. Volume sales fell -8.9% while prices were +31.2% higher. With two less trading days this year, like-for-like sales were up +31.0%. Four of the twelve categories grew more than total Merchants with Renewables & Water Saving (+59.5%) leading the pack. Landscaping (+31.2%), Timber & Joinery Products (+23.4%) and Heavy Building Materials (+21.5%) also fared well.

Month-on-month, total merchant sales dropped slightly (-0.9%) in October compared to September. Volume sales were also marginally down (-1.8%) and prices edged up (+0.9%). Plumbing, Heating & Electrical (+9.3%) grew most, followed by Tools (+5.4%). Seasonal category Landscaping (-8.1%) was the weakest.

Mike Rigby, CEO of MRA Research which produces this report, said: “The building industry does not operate in a vacuum and this year it’s been hit by the effects of political turmoil and economic UK own goals, and aggressive policies and events in Russia and China. Steeply rising interest rates, soaring energy costs, a cost-of-living crisis, a rapid slowdown in the housing market, plus beneficial freight rates tumbling back to normal, have all impacted the sector.

“Coming after a series of national lockdowns and a prolonged period of furlough, it’s hard to think of a time when the industry has had to face so many shocks to the system in such a short time. And the industry has coped remarkably well. But the roller coaster is not over. The new combination of Sunak and Hunt are safe hands but can they bring their party with them, and will their feet on the brakes postpone productivity improvements and growth? Who knows? And good luck to the boards who must put their budgets to bed before the start of 2023! It would be good to return to some sense of normality in 2023 but I wouldn’t bet on it.”

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation - is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.

October’s BMBI report, published in December, is available to download here.